Are Markets Listening to Us Finally + Oracle.

- Avory Team

- Dec 12, 2025

- 4 min read

Happy Friday everyone. I hope you tuned in to our webcast this week with Fiverr Founder and CEO. If not links below.

This was a big week for markets and a big week for the direction of the cost of capital. Rates have dropped 1.75% over the last 18 months and .75% over the last 4 months. Think about that for a second…

Also, we learned a lot on the AI front and we had meaningful updates from a few of the companies we invest in, so I’m sharing that context below.

Net-net, everything we’ve been talking about the last three to six months is creeping into the market mood. The economy is fine. The Fed is on a cutting path. Inflation and jobs are stable enough for them to keep going, no matter how hawkish or dovish the tone sounds in the moment. And that’s exactly what we got this week.

We’re also seeing how that backdrop translates into market behavior. Some rotation away from the highest-flying AI names and toward the more macro-sensitive parts of the market. We think that continues over the next 12 to 18 months because the facts are the facts and valuations are valuations.

Here is the summary if you want just that:

Oracles $120B issue.

Rates now 1.75% lower

Rents falling 1.1% Y/Y

Employee sentiment turning up

Zoom scores higher on AI.

The Fed cut rates this week and our conclusion from yesterday still holds.

Powell’s tone came in slightly more dovish than expected. Heading into the day, markets were positioned for something far more hawkish. That gap matters. It’s good news for assets going forward.

And we’re now hearing that the Treasury Department is preparing to release a corporate tax workaround that could reduce tax burdens for companies in the coming year. Details are TBD, but directionally it adds to the constructive setup.

During the press conference it was clear the Fed is watching jobs. Their view on inflation was more muted, and we think that’s the right call. It’s hard to see inflation re-accelerating when real-time rental rates are moving lower. Month over month rents are falling roughly 1 percent, the second-worst reading in five years.

Here’s year over year. Same thing. Falling 1.1%.

This is a major component of the inflation basket, which is why a flare-up in inflation looks unlikely from here.

People then ask whether falling rates could spark a surge in inflation. Likely not. Vacancy rates are sitting at five-year highs. There’s plenty of slack in the rental market.

How about jobs. Revelio updated their stats and one notable data point is employee sentiment finally picking back up after hitting record lows in 2024. That’s often an early signal of organizational health. And healthy organizations usually point to healthier underlying businesses.

We’re also seeing data points suggesting economic activity is starting to pick up. Post tariffs and post shutdown fears, leading indicators are turning higher. And with rates now 1.75% lower than 18 months ago, including 0.75% of cuts recently, that shift will be felt. This is the kind of setup where an inflection becomes real.

You’ve heard us talk about how traditional hiring is static, but entrepreneurship is elevated. That doesn’t show up in jobs data right away. I’d argue AI is a big reason for it. AI has become a powerful tool for people early in their entrepreneurship journey, lowering the barrier to getting something off the ground. So there are more people actively working and building when you take this into account.

Speaking of AI, we had several key announcements this week.

One of the biggest came from Rivian, which announced its own CUSTOM AI chip for autonomous driving. Good for the progress of AI overall, but less ideal for the current chip suppliers… unless your name is Broadcom.

We also saw Meta rumors swirling that they may shift toward building closed models. Two quick thoughts. First, closed models open the door to real monetization. Second, it adds pressure on OpenAI, which just went into a code red after Google’s Gemini momentum last week.

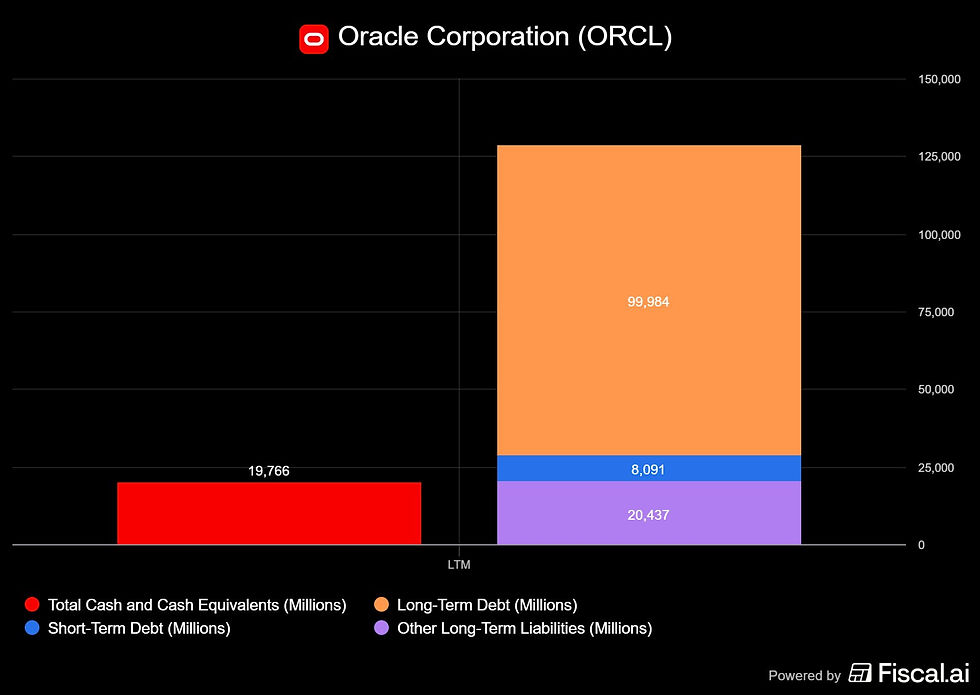

Lastly, we got earnings from Oracle, which has been a big story lately. Their business backlog is now above $500B, and a meaningful portion of that is tied to OpenAI, which today generates roughly $20B in annualized revenue. That math doesn’t math.

This matters when you look at Oracle’s balance sheet. They have more than $130B in liabilities and only about $20B in cash. They don’t currently have the capital structure to build for all of that future demand.

So investors are asking fair questions, and that’s why the stock is 30 to 40% off its highs.

To be clear, I like Oracle, they sit at the center of data, AI, and applications, but it’s tricky.

Now I have to add in several of our holdings.

Zoom continues to quietly win in AI. This latest benchmark has Zoom Federated AI scoring ahead of GPT-5 Pro, Claude Opus, and even Gemini 3 Pro. That’s not a fluke. It shows Zoom is building real capability where it matters most.

We also got news from Clear Secure, which jumped after announcing a contract with the Centers for Medicare and Medicaid Services to modernize identity verification. Integration with Medicare.gov is slated for early 2026. This validates our thesis that Clear is going from airport identity to enterprise.

Lastly, if you missed our Fiverr Fireside Chat with their founder and CEO Micah Kaufman. Here’s the link.

That’s all folks!

About Avory & Co.

Investing where the world is headed.

Avory specializes in high-conviction equity strategies, emphasizing Secular Growth and Transformation Stories driven by exceptional teams. Data guides decisions. We cater to high net worth investors, family offices, and institutional investors. Note: This information doesn't constitute a recommendation to buy or sell any mentioned securities. Avory is based in Miami, Florida with clients all across the globe.

Speak to us: Schedule a Brief Zoom Meeting

Send us an email: Team@avoryco.com

Want to invest? We are on most platforms.

Want More

🎥 Avory YouTube Channel

🎙️ Avory Podcast

Disclaimer: Not a recommendation to purchase or sell any securities mentioned. This is for educational purposes only.

Comments