Jump into Ai? or Small Caps? Or Both…

- Avory Team

- 10 hours ago

- 4 min read

Happy Friday everyone. Before year-end, we’ll be sharing our full year-end review and 2026 outlook. If you follow this newsletter, you already know our views and how we’re positioned relative to them. But overall, lots of insights to share to validate our research and data driven approach. If you recall, mid-year, we made a deliberate shift. We leaned into industry leaders that were more macro-sensitive, not because the businesses changed, but because valuations did. Simply put, they were flat out cheap and in growth markets. Love that combo.

This week was solid, with no major outliers. Small caps continued to perform well, while the AI trade took a hit as investors began questioning the scale of capital being deployed and the return on those investments. That naturally raises the question: is this the type of environment where you start stepping in selectively? Hmm…

On the macro front, several data points further support the path toward rate cuts. The inflation report, while clearly distorted due to the government shutdown, came in well below expectations. Inflation remains moderate and continues to move closer to the Fed’s target. As of today there is a ~30% probability of a rate cut next month, ~59% to 60% probability of a cut at the following meeting and rising odds of a 50 bp cut, moving from ~7% to over 12%…

That backdrop continues to reinforce our view. Let's jump into it.

Here is the summary if you want just that:

Inflecting small cap estimates!

Travel spending higher…

4 Year cycle for small caps…

Gen Ai #4

Look at small caps. Its not just cheap, earnings estimates are inflecting higher.

Combined with relative attractiveness on a valuation basis, we continue to get excited. Forward P/E ratios tell a very clear story.

Large caps and the Mag 7 are back toward the high end of their historical valuation range.

Mid caps and small caps remain meaningfully discounted relative to history.

The valuation gap between mega-cap growth and the rest of the market is wide.

Now, if the economy were rolling over, that wouldn’t be good. But let’s look at the facts.

Credit and debit data show a clear boom in spending on travel and leisure in Nov and Dec. Doesn’t signal to me any sort of weakness.

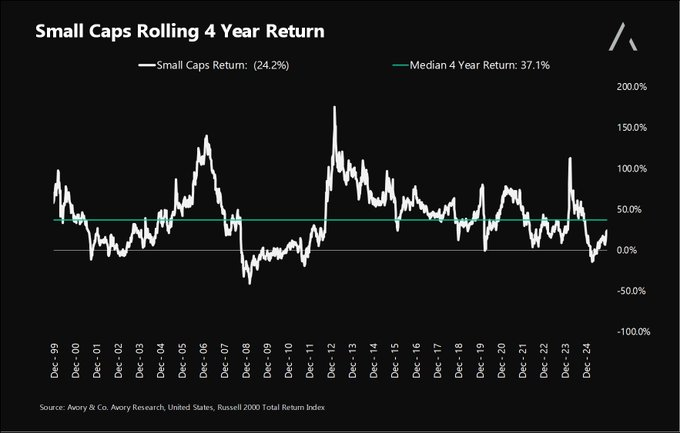

Now I will preview this from our annual outlook piece coming out but look at 4-year cycles for small caps. Returns have ranged from +175% to -40%, with a median of +37%.

We’re well below that median today. And if earnings come through, the upside case starts to looks higher than normal.

Technicals are saying the same thing. Our internal Avory dashboard, which measures rotation using a proprietary ranking system, is flagging strength in one place.

Micro caps and small caps.

Is this the start?

Now, there is some concern around AI. How do I know? Well, look at Sam Altman on CNBC wearing a suit. That means he means business.

Kidding. Sort of.

More seriously, OpenAI needs capital. And it increasingly looks like they’re preparing the market for an OpenAI IPO. I think an OpenAI IPO is closer than most people think. I said this recently and some random headlines are starting to confirm that.

Why this matters:

Public markets would unlock a massive new capital base.

A raise on the order of $100B doesn’t feel crazy in that context.

That capital would directly accelerate AI infrastructure, compute, energy, and data center buildouts.

Net-net, an OpenAI IPO wouldn’t be a top signal as some have suggested, I think it’ll be fuel for a massive bubble.

Now AI is humming along. Just look at the growth of AI apps in the App Store. Almost overnight, it feels like they’ve leapfrogged every other category. That’s not hype. That’s usage, distribution, and demand showing up in real data.

Here’s another look…

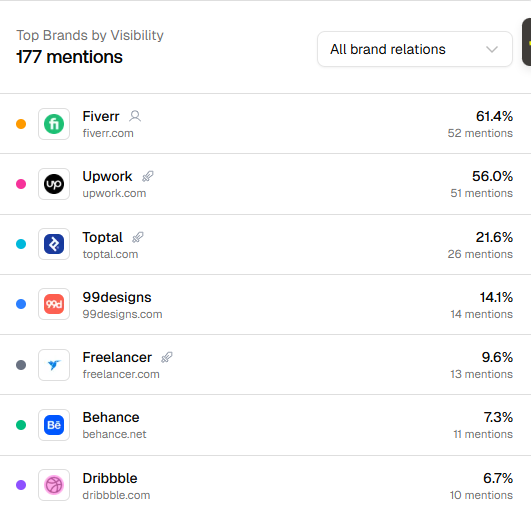

Last point on AI, and tying it back to one of our holdings: Fiverr. Generative search is fast and increasingly replacing traditional search. That matters because the old SEO playbook is changing things.

Historically:

You built a brand

The brand produced content

Search engines ranked that content

Top-of-funnel demand flowed to the dominant domains

If you won SEO, you won demand. With GEO (generative engine optimization), the game resets in many ways. It feels like starting from zero. But here’s the key insight many miss. Strong brands still win. You just have to tune content for how AI models ingest, summarize, and recommend.

The good news?

We track this closely across our portfolio. And Fiverr ranks #1 in its category in generative search visibility.

Happy holidays and look out for the outlook piece!

About Avory & Co.

Investing where the world is headed.

Avory specializes in high-conviction equity strategies, emphasizing Secular Growth and Transformation Stories driven by exceptional teams. Data guides decisions. We cater to high net worth investors, family offices, and institutional investors. Note: This information doesn't constitute a recommendation to buy or sell any mentioned securities. Avory is based in Miami, Florida with clients all across the globe.

Speak to us: Schedule a Brief Zoom Meeting

Send us an email: Team@avoryco.com

Want to invest? We are on most platforms.

Want More

🎥 Avory YouTube Channel

🎙️ Avory Podcast

Disclaimer: Not a recommendation to purchase or sell any securities mentioned. This is for educational purposes only.

Comments