Macro Names Ready to Move?

- Avory Team

- Nov 16, 2025

- 3 min read

As we roll into the holiday season, we’re tracking consumer spending closely. A healthy consumer is the backbone of any recovery, and so far the data looks steady.

What most people don’t realize is that roughly 2/3 of the Nasdaq Composite is actually down this year. Whoa. So lots of weakness out there, which is probably why sentiment remains low.

That matters because our portfolio is positioned for a rebound in macro sensitive names, some of those haven’t caught a bid in 2025. We’ve added new positions and increased a few existing ones.

The setup looks healthy pushing forward, so let’s break it down.

Here is the summary if you want just that:

Consumers keep spending. +4%

Small caps significantly appreciated.

2/3 of Nasdaq down YTD

Small Caps Positive During 2000/2001

Big part of our thesis heading into 2026 is that consumer is fine, rates head lower, recent cuts take little time to be felt, and markets will turn back to favoring small caps. Let’s take a look.

Credit card sending shows household spending rose +4.2% Y/Y in the week ending Nov 8.

Clothing was +6.4%, electronics +4.8%, and restaurants +2.4%. Entertainment flat but improving from -14% two weeks prior. This is what steady consumption looks like.

This is probably why Small cap EPS is expected to grow roughly 45% over the next 12 months compared to about 12% for the S&P. Over the following 12 to 24 months, small caps still outpace large caps by more than 15%.

Seems interesting right?

Just as investors when asked which are do they favor, small caps is around 4%. So again significantly more favorable fundamental backdrop mixed with bad sentiment, potentially suggests lopsided trade.

Now in aggregate investors remains nervous. 49% are bearish and another 19% remain nervous.

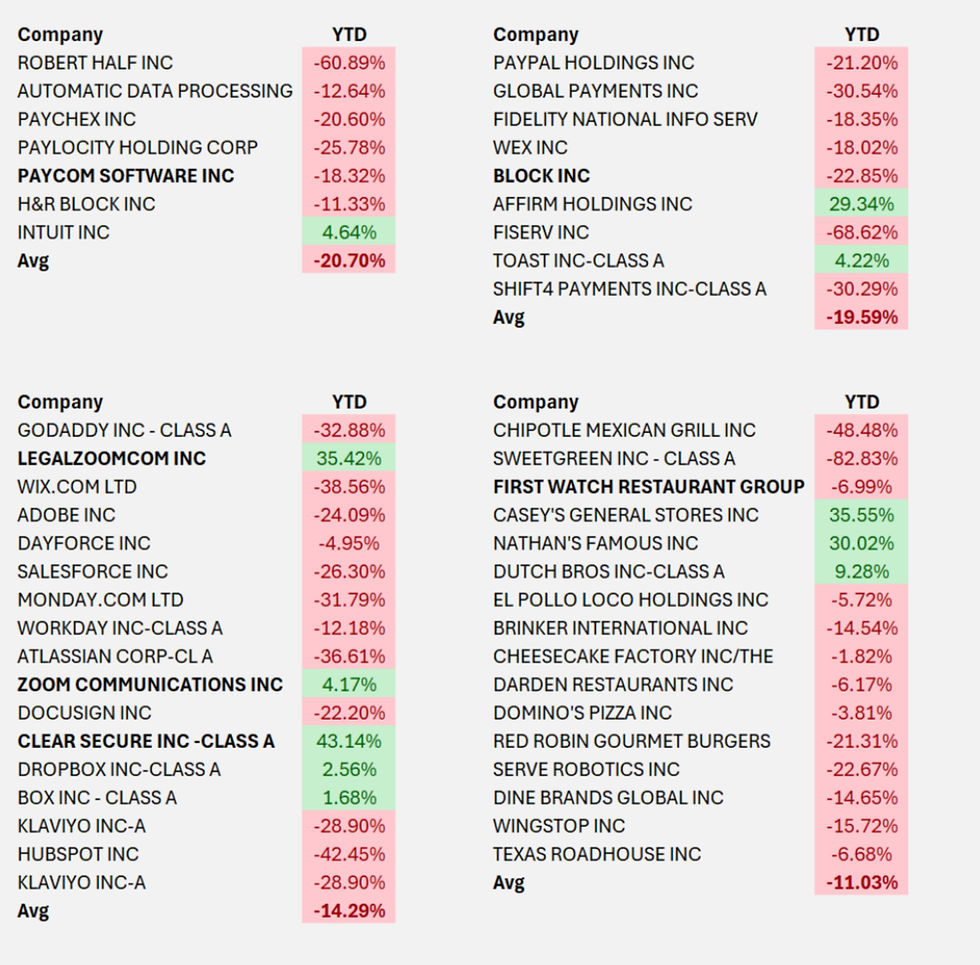

Now we look at various parts of market and as you can see, macro sensitive names have been hit. This ties to small and mid caps too.

It’s not just isolated to macro names too. Nasdaq is doing so good right? Wrong. Nearly 65% of stocks in Nasdaq Composite are down in 2025.

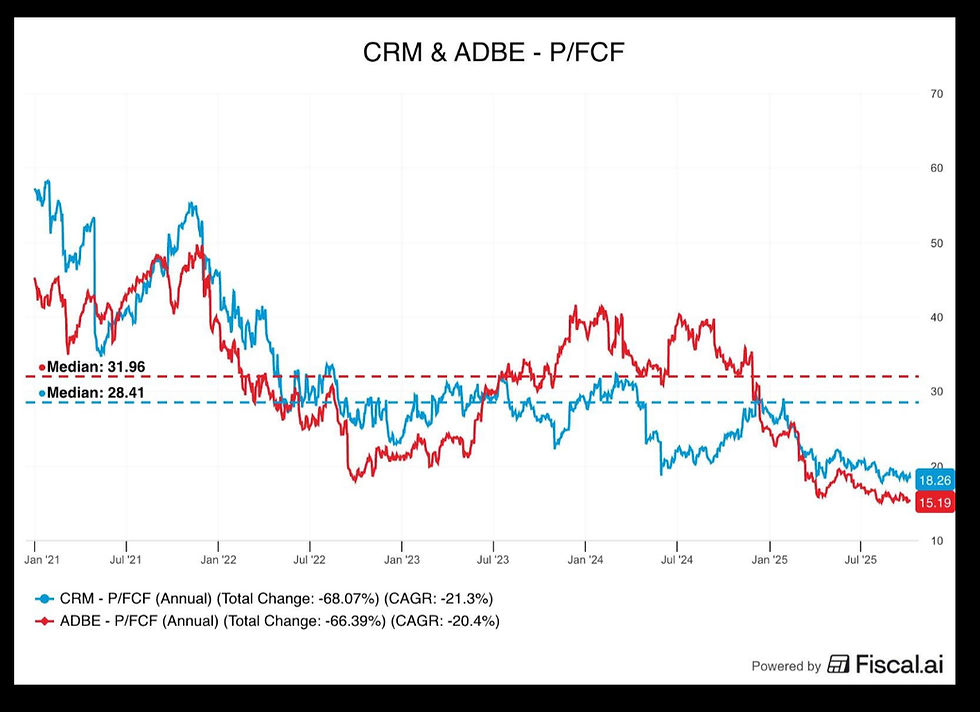

It’s not just some small names, but look how cheap Saleforce and Adobe have gotten. Record cheapness. Partially fears of macro and partially fears of AI.

I’ve heard the narrative that we’ll this a bubble so if it’s a bubble small and mid caps would get hit hard. So let’s dig little bit deeper.

Here’s valuations. It’s pretty clear that Mag 7 is where the outlier on valuation is versus everything else.

That shows here where returns are also at near record lows.

In 2000 this same setup existed. Here’s what happened. S&P fell, while small caps rose.

Long story short markets haven’t been kind to macro sensitive names in 2025, 2/3 of Nasdaq are also down, BUT economic activity remains resilient. So we expect brighter moves ahead in these parts of market as rate cuts, tax refunds in Q1, and sentiment improves.

About Avory & Co.

Investing where the world is headed.

Avory specializes in high-conviction equity strategies, emphasizing Secular Growth and Transformation Stories driven by exceptional teams. Data guides decisions. We cater to high net worth investors, family offices, and institutional investors. Note: This information doesn't constitute a recommendation to buy or sell any mentioned securities. Avory is based in Miami, Florida with clients all across the globe.

Speak to us: Schedule a Brief Zoom Meeting

Send us an email: Team@avoryco.com

Want to invest? We are on most platforms.

Want More

🎥 Avory YouTube Channel

🎙️ Avory Podcast

Disclaimer: Not a recommendation to purchase or sell any securities mentioned. This is for educational purposes only.

Comments