What Data Says About The Jobs Market…

- Avory Team

- Oct 3, 2025

- 3 min read

Happy Friday!

The past two weeks brought some volatility as markets shifted back to macro fears. We saw this almost exactly a year ago when growth scares hit the most macro-sensitive parts of the market. The blackout in jobs data from the government shutdown only added fuel to those concerns.

But today we show you what we see: a stable jobs market across multiple datasets. We expect more cuts, and history tells us what comes next. Volatility on the downside is often met with upside as cheap, double-digit growers ultimately prevail over time.

Let’s get into the data!

Here is the summary if you want just that:

Ai not impacting admins?

+80k jobs in September…

+60k jobs in September

Confidence perked up

Today we’re just focusing on jobs.

Markets have circled back to worrying about the economy and whether the Fed risks being late, especially with recent BLS revisions and no new reports during the shutdown.

But the data we track tells a clear story: in a labor market that’s been full, the trend is still stability, not cracking. Fewer hires and fewer fires point to more cuts ahead, not fewer. Revelio Labs’ which we had our podcast recently, the latest data shows non-farm employment rising +60K in September, which would be above consensus. After two years of slowing, monthly gains have settled into a steady band.

That is normalization, not outright weakness. With inflation subdued, cuts should be a tailwind, not a lifeline, but they do need to cut.

Here is the headline on the data.

Now let’s turn to another data source that has also proven directionally accurate. Based on the tracking, the U.S. added a net gain of 80K jobs in September.

Taken together with Revelio’s read, the signal is consistent: the labor market remains stable enough.

Employee confidence improved in September across sectors tied to consumer spending. Personal consumer services rose +2.6 pp M/M, restaurants and food service +1 pp, and retail and wholesale +1.4 pp. The takeaway: tariffs have not weighed on consumer spending as much as feared.

Paychex data also shows small business hiring remains pretty stable.

Now lets turn to LinkedIn data. It shows national hiring was essentially flat from July to August, rising just +1%. Compared to both January 2025 and a year ago, hiring is down -4%, though the pace of decline has eased compared to prior years.

We also have LinkUp data showing where job openings are strongest and weakest.

Interestingly, administrative roles rank #4 on the list. Weren’t these the jobs AI was supposed to crush? Instead, demand remains resilient, a reminder that technology disruption often plays out more slowly and differently, than the headlines suggest.

Looking at LinkUp’s mid-month time series, which aligns more closely with the BLS survey period, total U.S. job openings rose +3% from August 20 to September 19. New job openings climbed even faster, up +8%.

Then we got Google searches. Same story. Nothing showing up.

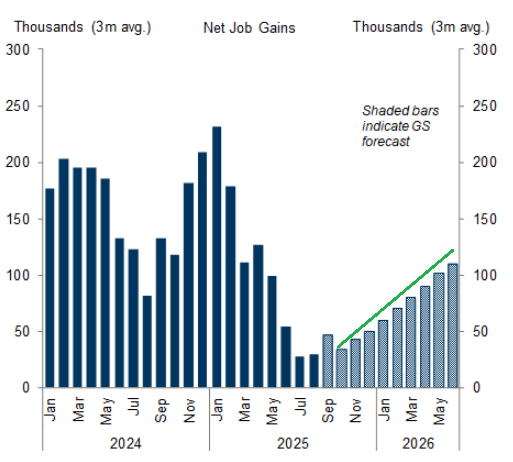

Add in Goldman’s view that job growth should trend higher over the next six months. If that plays out, we’ll be very happy, because it means the market will come back fishing where we are most exposed.

That’s the reminder: data drives our views. Don’t let headlines or short-term volatility spook. Patience pays.

Have a great weekend.

About Avory & Co.

Investing where the world is headed.

Avory specializes in high-conviction equity strategies, emphasizing Secular Growth and Transformation Stories driven by exceptional teams. Data guides decisions. We cater to high net worth investors, family offices, and institutional investors. Note: This information doesn't constitute a recommendation to buy or sell any mentioned securities. Avory is based in Miami, Florida with clients all across the globe.

Speak to us: Schedule a Brief Zoom Meeting

Send us an email: Team@avoryco.com

Want to invest? We are on most platforms.

Want More

🎥 Avory YouTube Channel

🎙️ Avory Podcast

Disclaimer: Not a recommendation to purchase or sell any securities mentioned. This is for educational purposes only.

Comments